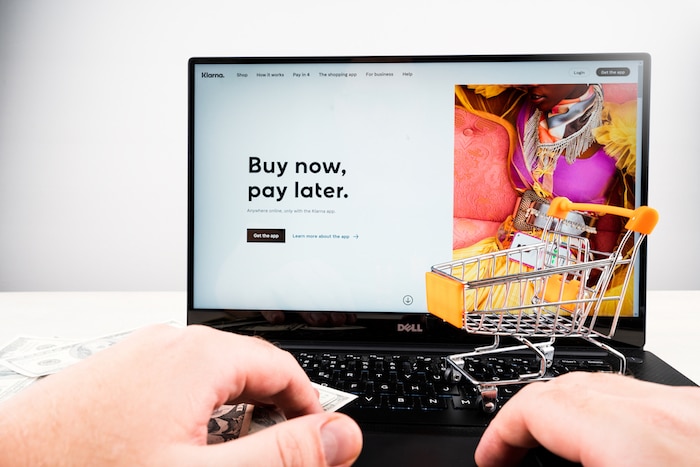

Consumers prefer to have multiple options when deciding how they want to pay for purchases. At the height of the pandemic, online shopping became the thing to do because people had little or no access to physical stores. Similar to other conveniences designed to make buying online more effortless, the option to Buy Now Pay Later (BNPL) grew in popularity. Although this payment method has been around for some time, the opportunity to divide the cost of purchases into multiple equal payments becomes more attractive for shoppers who prefer to receive the product now but pay for it in the future.

Growing Demand for Digital Payments Options

Feedback from consumers indicates consumers like BNPL plans because it helps them manage their payments and extends their purchasing power. The plans are beneficial for buying expensive products and luxury items. In the case of BNPL, eager shoppers may have to wait a while before it’s widely available online or in physical stores. According to the report, “BNPL And the In-Store Opportunity, a collaboration between PYMNTS and Zip, identify ways that retailers can catch up with the consumer demand and create a loyal following across their online and physical stores.

More Big-Ticket Sales for Retailers

For independent retailers offering customers the ability to participate in a BNPL plan may be an opportunity to sell more big-ticket items such as high-end grills, power tools, outdoor furniture, building materials, or gardening equipment. Retailers who currently offer BNPL plans have discovered that consumers are more likely to buy products rather than simply looking and then moving on. These shoppers also spend more money with merchants who make BNPL available. Although these transactions typically occur online, the report suggests that integrating the purchasing method in-store can easily be accomplished by integrating the BNPL option into the point-of-sale (POS) system.

Giving Shoppers the Flexibility They Want

To understand how consumers feel about BNPL as an option for purchasing merchandise online or in-store, PYMNTS and Zip surveyed 2,025 consumers in the U.S. They then identified four retail categories. These are big box stores such as Home Depot, department stores including JC Penny, specialty retailers such as Tiffany’s, and local businesses that include hardware stores.

- 66 percent of millennials have a favorable view of luxury and specialty retailers that offer BNPL as an option online and in-store

- 56 percent of respondents who shop at specialty stores and buy luxury products are highly-interested in using BNPL plans for online purchases

- 46 percent of shoppers would switch to another retailer that offers BNPL as a payment option

Usage is Higher Online than in Physical Stores

Currently, the percentage of BNPL transactions occurring in physical stores is a fraction of the purchases made online using this payment method. About 10 percent of shoppers who purchased luxury items online used a BNPL plan versus 1.8 percent of customers who bought similar items in a physical store. Retailers who want to attract more millennials have an opportunity to develop promotions targeting this consumer group who are entering their highest-earning period.

Retail is Driving Adoption of BNPL Transactions

As more consumers become familiar with the benefits of using a BNPL plan, the adoption rate will steadily increase. Merchants who opt not to participate risk falling behind competitors who see BNPL as an opportunity to sell more products and attract new customers. Now is the time to educate consumers about these transactions and leverage the momentum that is occurring online to drive in-store sales. Ultimately offering BNPL can increase bottom-line profits and customer satisfaction.